Investment Characteristics

Loyal Hands-on Approach

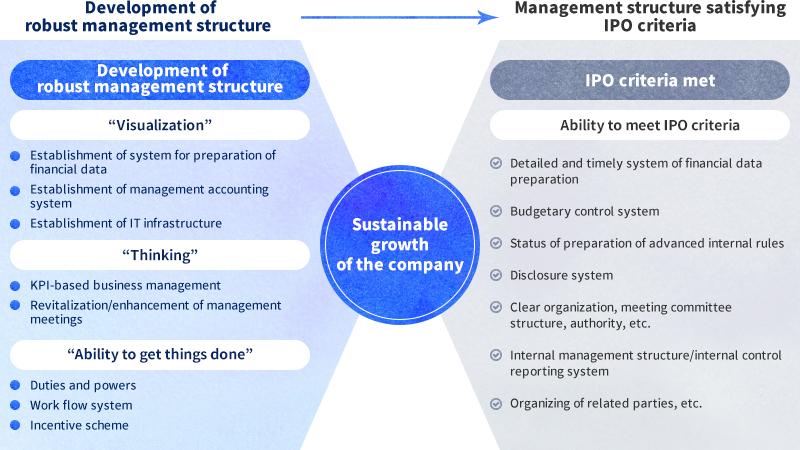

We have seen many cases where management support did not go well when attempting to simply transplant outstanding know-how. Know-how is not to be imposed without listening to the other party. An important factor in achieving improvements is ensuring that action is taken with the complete understanding of the front lines. Based on our many years of experience, we are well aware of the need to think about management from the same perspective of the management and employees. As a result, we understand how to implement the transition of management know-how smoothly. We have closely guarded internal rules for our hands-on approach, and we provide thorough instruction to the members of our Group on how to speak and behave at the companies in which we invest. Under this policy, we develop a robust management structure that withstand an IPO by taking roughly three to four years to make improvements in the three key areas of visualization, thinking and the ability to get things done.

- First year after investmentVisualization

- Refine the monthly financial data preparation and identify and share the key performance indicators (KPI).

- Second year after investmentThinking

- Execute a PDCA cycle company-wide based on the KPI and bring the company to a level where it can analyze factors for success and failure and make proposals for improvement.

- Third year after investmentAbility to get things done

- Actually execute the improvement proposals and new businesses based on the PDCA cycle and bring the company to a level where efforts can be tied into results.

Approach to Improving Management

Provide support for developing a robust management structure that withstand an IPO (or listing)

Management structure satisfying IPO criteria (1)

“Visualization” = Ascertaining numerical information for correct understanding of current situation

Show information and data necessary for business management in numerical form and create a system for correct understanding of the current situation related to business results

- System for preparation

of financial data -

- Detailed and timely preparation of financial data

- Management

accounting system -

- Ascertaining of granular profit and loss structure necessary for business management and KPI*1

- IT infrastructure

-

- Non-manual consolidation and output of information and data

(*1) KPI: Key performance indicators

What is necessary for “Visualization”

- System for preparation

of financial data -

- Establishment of system for preparation of financial data (monthly, quarterly and annual)

- Refinement and expediting of monthly financial data preparation

- Establishment of financial closing method (unification of financial breakdown and adjustment accounting)

- Verification of consistency between financial data and actual situation

- Transition from tax accounting to financial accounting

- Preparation of consolidated financial statements

- Establishment of system for preparation of financial data (monthly, quarterly and annual)

- Management

accounting system -

- Analysis of profit structure and establishment of KPI

- Subdivision of management units such as profit and loss by division or product

- Review and restructuring of cost control through cost accounting system

- IT infrastructure

-

- Review and restructuring of production, inventory and sales systems

- Development of accounting system linked to above operational systems

“Visualization” Examples

Management structure satisfying IPO criteria (2) “Thinking”

“Thinking” = Logical management based on numbers

Conducting a logical analysis based on the numbers ascertained through “visualization” and creating a system capable of recognizing substantive issues and planning solutions

- KPI-based

business management -

- Establishment of KPI targets

- Monthly analysis of business results and budgetary control via KPI monitoring

- Revitalization/enhancement

of management meetings -

- Recognition of management issues and planning of solutions based on monthly analysis

- Establishment of conference-type management meeting

Specific Examples of “Thinking”

- KPI-based

business management -

- Clarify profit structure by customer segment, product, etc. through fact data analysis

- Management shares factors behind disparities with business results compared to budget/previous year in regards to several important KPI

- Revitalization/enhancement

of management meetings -

- Measures for making improvements in the following month based on business results are reported by each division at the management meeting

- The next steps are adopted immediately based on results of analysis and discussion at the management meeting

- Measures are decided not by the owner on his or her own but as a result of management discussions based on analysis

“Thinking” Examples

Management structure satisfying IPO criteria (3) “Ability to get things done”

“Ability to get things done” = Ability to penetrate front lines

Creating a system where the front lines can think and act on their own

- Duties and powers

-

- System where individuals can think and act on their own authority while delegating authority

- Work flow system

-

- Work flow system in which tasks are carried out daily under clear duties and powers

- Introduction of

incentive scheme -

- Incentive scheme where maximization of company profits penetrates to the individual executive level

What is necessary for “Ability to get things done”

Creation of a system for knowing and fairly evaluating how individual employees are contributing to the company

- Duties and powers

-

- Preparation of internal rules for systematic company operations

- Clarification of authority and discretion taking into account the mobility of the front lines

- Work flow system

-

- Review and restructuring of each work flow according to duties and powers

- System of checks and balances based on development of internal control

- Introduction of

incentive scheme -

- Introduction of satisfactory personnel system based on common ground

- Merit-based personnel system that maintains and improves employee motivation

- Personnel system rooted in the corporate culture and climate

- Introduction of satisfactory personnel system based on common ground

Messages from Our Investment Team Members

- The most salient feature of our hands on effort is the idea that we think and sweat along with those in the field. As a major shareholder, or even a director of the company, it is hard to understand the real issues confronting a portfolio company by just listening to the officers’ reports once a month, and we don’t believe that it’s possible to offer truly meaningful recommendations and support without a deep understanding of the practices and hardships of those in the field.

(Naoki Ito)

- The members of the Group have backgrounds that run the gamut from trading houses and other business enterprises to financial institutions, consulting firms, attorneys and certified public accountants. The investment review committee discussions can become fairly heated as members with differing backgrounds use their specialized knowledge to carefully examine a deal from all aspects. One of the most important characteristics of this review process is that we focus on finding the elements that will benefit from our hands-on attention.

(Toshihiko Ishigami)